Liberty Helps Business Owners Financially Prepare for Unexpected Events

MELBOURNE, Australia, Could 09, 2022 (World NEWSWIRE) — With SMEs dealing with many hurdles for the duration of the previous two many years, Liberty says exploring flexible enterprise financial loans can assistance business entrepreneurs get ready for foreseeable future unforeseen functions.

From cyberattacks to source chain disruptions, labour shortages and a world wide pandemic, Australian SMEs have dealt with various unforeseen concerns impacting their functions.

Whilst optimism is rising amongst enterprise entrepreneurs at present rebounding from these problems, notice ought to now change to for a longer time-term setting up and preparing.

Securing fast access to funding as a result of a company bank loan in advance of time can offer corporations with an added income buffer when the unanticipated transpires.

For non-lender financial institution Liberty, helping small business homeowners actively put together for the upcoming with the right finance remedy is an vital component of their services.

Liberty’s Head of Shopper Communications, Heidi Armstrong, said: “With help from professional loan providers this sort of as Liberty, Australian small corporations have larger opportunities to return to full strength and attain their objectives.”

Adopting a personalised technique allows Liberty to give tailor-made remedies suited to the special desires and instances of each and every company proprietor.

Whilst several corporations are nevertheless searching for traditional business loans, Liberty suggests line of credit rating amenities are an significantly common alternative for SMEs thanks to their adaptability.

Liberty Obtain is the lender’s possess line of credit business financial loan intended to enable firms attain the credit they will need to increase, seize new prospects and succeed. As opposed to other business loans, Entry only sees curiosity billed on the total applied.

Prevalent utilizes for line of credit score services these kinds of as Liberty Accessibility consist of having to pay staff wages, masking invoices, getting urgent inventory and shelling out suppliers.

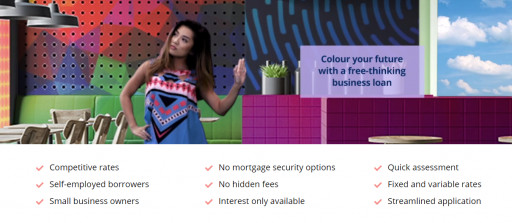

Liberty also offers fascination-only alternatives and business financial loans without the need of mortgage stability demands. And, with rapidly turnaround moments, Liberty is perfectly-outfitted to assist small business buyers to attain cash when essential.

Even those with a considerably less-than-best business enterprise credit rating rating are inspired to speak with a Liberty Adviser for assistance to find a remedy that matches their requires. There may be additional solutions readily available than first assumed.

Approved candidates only. Lending criteria apply. Costs and charges are payable. Liberty Economic Pty Ltd ACN 077 248 983 and Secure Funding Pty Ltd ABN 25 081 982 872 Australian Credit Licence 388133, with each other buying and selling as Liberty Fiscal.

Contact

Heidi Armstrong

Group Supervisor – Purchaser Communications

P: +61 3 8635 8888

E: [email protected]

Linked Pictures

Organization Loans

This articles was issued by means of the press release distribution provider at Newswire.com.