Envela’s Venture Into Electronics Re-Commerce Is Paying Off

Galeanu Mihai

Introduction

I like writing about undercovered stocks on SA, and currently I am having a glance at Envela Corporation (NYSE:ELA). It really is a re-commerce retailer that has far more than tripled its gross sales given that 2016 and seems set to e book a internet income of around $10 million for 2022. The organization has a market place capitalization of virtually $200 million as of the time of writing, but I consider it can be low-priced looking at how effective its turnaround has been thanks to the enterprise into electronics. Let us review.

Overview of the enterprise and financials

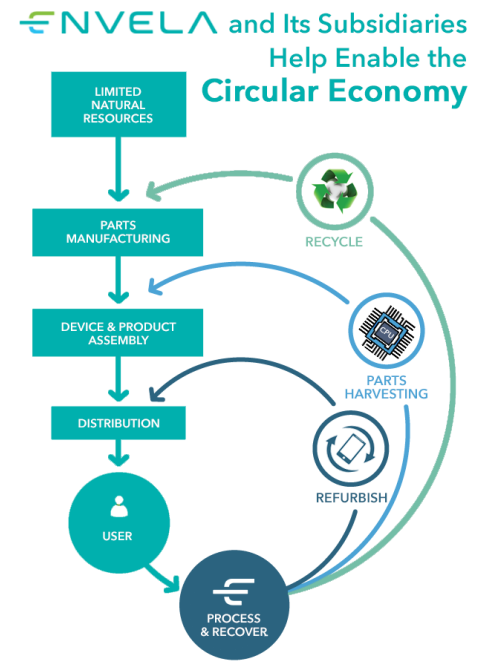

Envela was founded in 1965 and is amongst the largest authenticated re-commerce stores of luxurious challenging belongings in the United states. The firm’s small business is break up in two working segments. Its DGSE subsidiary is concerned in the obtain, and re-sale or recycling of jewelry, diamonds, gemstones, wonderful watches, rare coins, gold, and silver and it has a network of 7 jewelry merchants throughout the state of Texas and South Carolina. Its manufacturers involve Dallas Gold & Silver Exchange, Charleston Gold & Diamond Exchange, and Bullion Express. Envela’s ECHG subsidiary, in transform, specializes in the order and recycling or refurbishment of client electronics and IT equipment. This segment generates revenues by means of re-selling, end-of-lifestyle electronics recycling, and IT property disposition expert services. ECHG aims to increase the valuable everyday living of electronics via re-commerce whenever doable, and it recycles items by means of the removing of usable elements for re-sale as elements, or by extracting the beneficial metals.

Envela

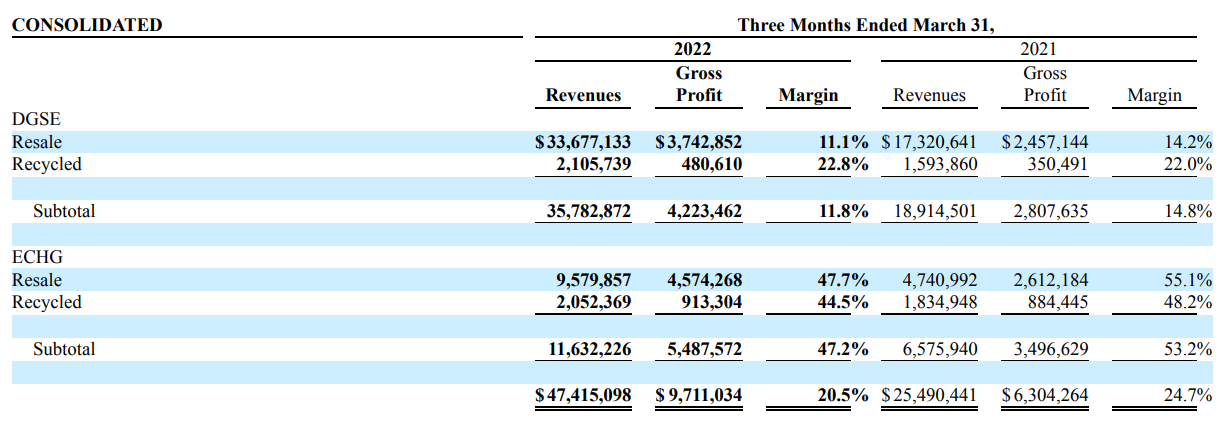

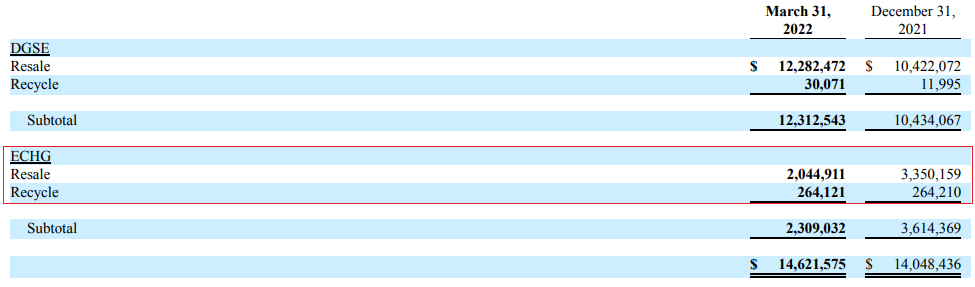

On the lookout at the hottest available financials of Envela, we can see that the huge vast majority of the firm’s revenues are coming from re-promoting and not recycling and that ECHG has a lot improved margins than DGSE.

Envela

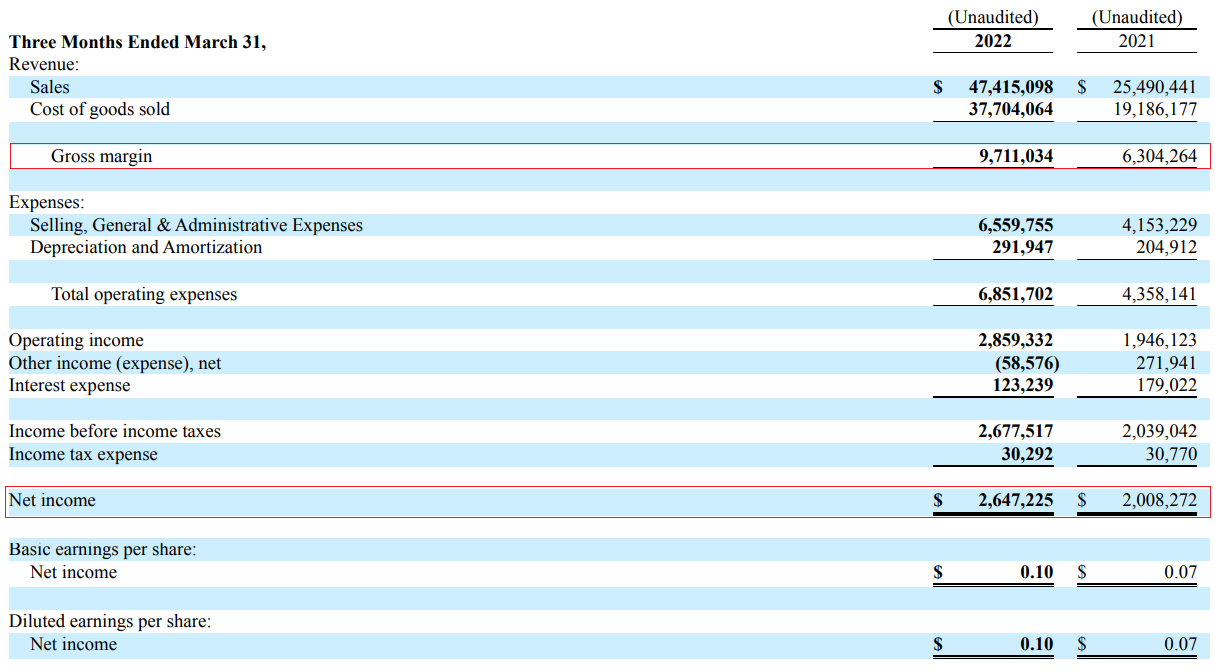

You can also detect that the revenues of both segments registered sizeable progress in Q1 2022. DGSE’s embarked on an on the internet advertising and marketing and promoting marketing campaign all through the period and boosted its advertising spending plan by 56%. It looks the advertising and marketing marketing campaign was effective. I think the boost in ECHG’s revenues, in convert, can be attributed to the buy of two businesses in 2021. In June 2021, Envela acquired electronics trade-in and recycling service company CExchange. In October, the company obtained IT asset disposition providers company Avail. All round, I consider Q1 2022 was a fairly solid period of time from a financial place of watch for Envela as the gross revenue soared by 54% to $9.7 million while the net profits rose by almost 32% to $2.7 million. In my look at, the company is very likely to reserve a internet revenue of over $10 million for 2022.

Envela

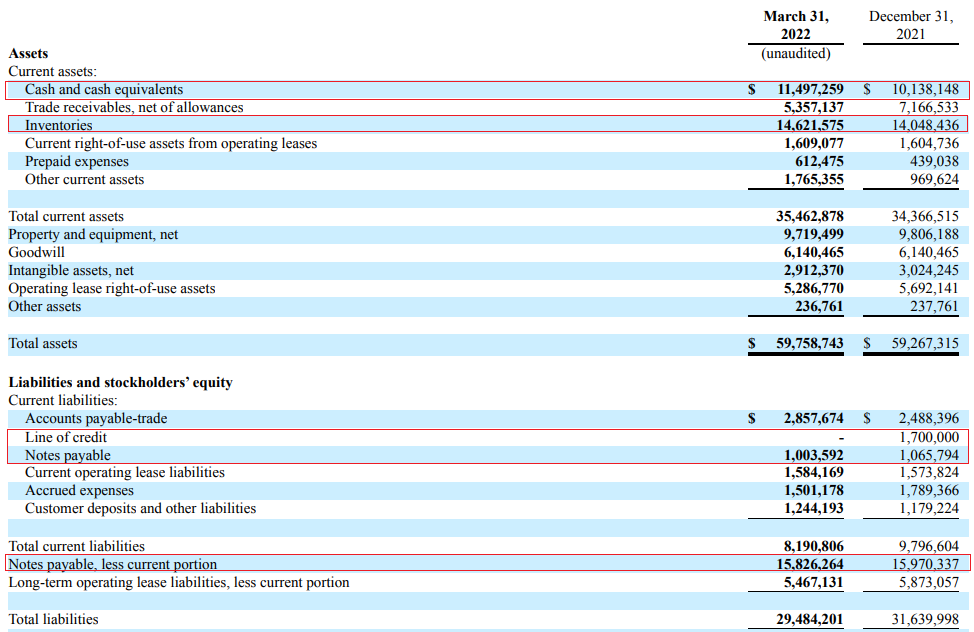

Turning our awareness to the stability sheet, we can see that Envela has a relatively asset-light-weight business enterprise with cash and inventories accounting for pretty much half of the asset base as of March 2022. Financial debt stood at $16.8 million at the stop of the quarter, which I assume is simply manageable considering cash and dollars equivalents have been $11.5 million. In addition, funds expenditures are expected to be just all over $1 million over the coming 12 months. In my watch, Envela has ample liquidity to finance a person or two much more acquisitions in the in close proximity to potential.

Envela

Envela looks overvalued at first look, as it has a market place valuation of $197.1 million as of the time of composing. The firm is trading at an EV/EBITDA several of 17.8x on a TTM foundation. Nevertheless, I think it is really cheap as its business has been rising promptly given that the appointment of John Loftus as CEO and President in December 2016. Envela closed 2016 with profits of $48.3 million, down from $127.9 million in 2012. The internet decline, in switch, had widened $1.6 million to $4 million. So, how has the business managed to get back again in the black and surpass its 2012 profits amount in a interval of a lot less than 5 decades? Properly, it all began with slashing SG&A expenditures. And in 2019, Envela bought Echo Environmental and ITAD Usa for $6.9 million from Loftus to produce ECHG. You see, the gross margin of Envela was 17.2% in 2016, but the small business was barely sustainable as SG&A expenses have been in excess of $10 million for each year. I feel that DGSE however is not a good small business owing to the relatively very low margins, and it looks that most of the sizeable improvement in profitability in excess of the past 3 a long time has been coming from the shopper electronics and IT machines segment. I think that this expansion is possible to continue as it has sturdy momentum that even the COVID-19 pandemic couldn’t place an end to it. The enterprise has also manufactured many bolt-on acquisitions above the past many yrs, and CExchange and Avail are the most recent kinds.

Seeking at the dangers for the bull situation, I imagine that the major one particular is the sourcing of inventory. While Envela inventory was at a healthy amount of $14.6 million as of March 2022, most of that total was linked with DGSE. The substantial-margin ECHG company experienced inventories of just $2.3 million at the finish of Q1 2022.

Envela

1 of the main sources of stock for ECHG is college districts, and it truly is probable that a recession in the United states could lead to lessen schooling investing, which would in transform hurt this business.

An additional chance to take into account listed here is that the fiscal effects of ECHG’s recycling enterprise and DGSE are substantially influenced by important and other non-ferrous metallic charges. If gold and silver selling prices drop, Envela’s margins will tumble.

Trader takeaway

Envela has reached a sizeable turnaround of its company about the earlier couple of several years, and I feel that the most significant element for this was the buy and enhancement of the superior-margin consumer electronics and IT tools ECHG enterprise. This phase is growing swiftly, and its margins remain about 40% which is why I view Envela as undervalued at the minute. If expansion fees are sustained, I consider that the company’s shares ought to be investing at anything like $9.00 in the around foreseeable future.

Nevertheless, I am involved that inventories at ECHG were being at a reduced degree as of March, and this could guide to concerns down the street. In view of this, I charge Envela as a speculative acquire.