New Mountain Finance Stock: Defensive BDC On Sale (NASDAQ:NMFC)

ipopba/iStock through Getty Photographs

New Mountain Finance (NASDAQ:NMFC) is a business growth enterprise with a growing and effectively-managed portfolio, floating publicity that implies increased portfolio cash flow as curiosity charges increase, and a minimal non-accrual amount.

Additionally, the organization growth business covers its dividend payments with net investment earnings, and the stock at present trades at a 13% discounted to e book worth. The inventory is appealing to dividend traders looking for significant recurring dividend cash flow, when NMFC’s minimal valuation relative to reserve benefit leaves space for upside.

Buying A 10% Yield At A Lower price

Underneath the Expense Corporation Act of 1940, New Mountain Finance is categorised as a Small business Growth Organization. The BDC is managed externally, which signifies it pays one more corporation for administration providers. New Mountain Finance primarily invests in middle-marketplace firms with EBITDA of $10 to $200 million.

The the greater part of New Mountain Finance’s investments are senior secured personal debt (1st and next lien) in industries with defensive characteristics, which usually means they have a significant likelihood of accomplishing effectively even in recessionary environments. New Mountain Finance’s core organization is middle industry personal debt investments, but the firm also invests in web lease homes and equity.

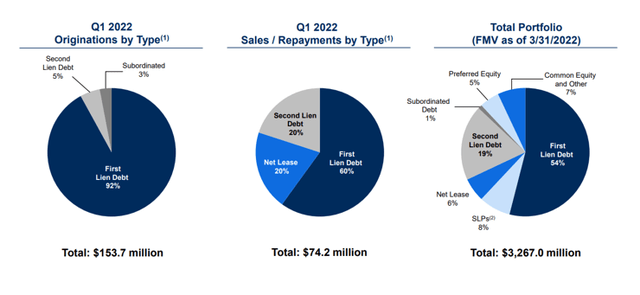

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% 1st lien personal debt and 19% 2nd lien personal debt, with the remainder spread throughout subordinated financial debt, equity, and net lease investments. In the initial quarter, almost all new mortgage originations (92%) were being first lien personal debt.

The whole exposure of New Mountain Finance to secured first and 2nd lien financial debt was 73%. As of March 31, 2022, the firm’s full portfolio, including all debt and equity investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

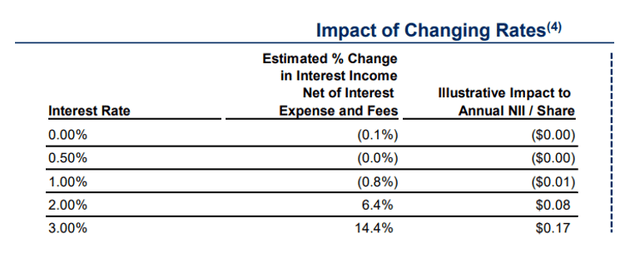

Desire Amount Exposure

New Mountain Finance has taken care to make investments mostly in floating level debt, which ensures the investment decision company a loan charge reset if the central lender raises curiosity fees. The central bank raised fascination premiums by 75 foundation points in June to battle soaring inflation, which strike a four-10 years superior of 8.6% in May. An maximize in benchmark curiosity charges is anticipated to outcome in a considerable enhance in internet interest cash flow for the BDC.

Effect Of Switching Prices (New Mountain Finance Corp)

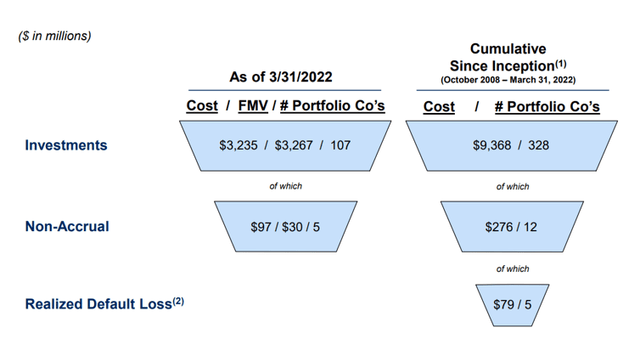

Credit score Performance

The credit rating performance of New Mountain Finance is excellent. As of March, five of 107 companies were being non-accrual, representing a $30 million truthful worth exposure. Considering the fact that the BDC’s whole portfolio was well worth $3.27 billion in March, the non-accrual ratio was .9%, and the organization has however to realize a loss on these investments.

Non-Accrual Ratio (New Mountain Finance Corp)

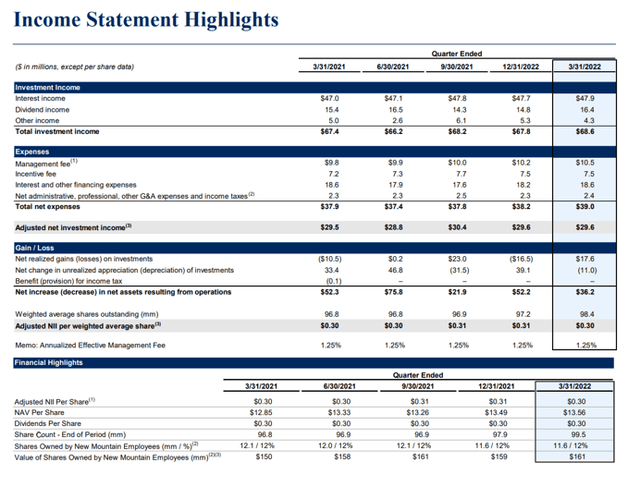

NII Handles $.30 For every Share Quarterly Dividend Pay out-Out

New Mountain Finance’s dividend of $.30 for every share is covered by modified web expense cash flow. In the earlier calendar year, New Mountain Finance had a spend-out ratio of 98.4%, indicating that it has consistently included its dividend with the money produced by its financial loan investments.

Even although New Mountain Finance at this time covers its dividend with NII, a deterioration in credit rating high quality (mortgage losses) could bring about the BDC to beneath-generate its dividend at some issue in the potential.

Cash flow Statement Highlights (New Mountain Finance Corp)

P/B-Several

On March 31, 2022, New Mountain Finance’s e book price was $13.56, although its inventory selling price was $11.84. This usually means that New Mountain Finance’s financial commitment portfolio can be acquired at a 13% discount to book value.

In latest weeks, BDCs have started to trade at greater bargains to e book price, owing to issues about climbing fascination fees and the likelihood of a economic downturn in the United States.

Why New Mountain Finance Could See A Decrease Valuation

Credit history quality and ebook benefit traits in company development firms show buyers regardless of whether they are dealing with a trustworthy or untrustworthy BDC. Organizations that report very poor credit history good quality and e book value losses are generally pressured to minimize their dividends. In a downturn, these BDCs ought to be averted.

The credit history quality of New Mountain Finance is sturdy, as calculated by the degree of non-accruals in the portfolio. Credit score quality deterioration and ebook benefit losses are risk aspects for New Mountain Finance.

My Conclusion

New Mountain Finance is a very well-managed and inexpensive business progress corporation to spend in.

At the moment, the inventory rate is decrease than the NMFC’s ebook worth, implying that the BDC can be bought at a 13% lower price to ebook value.

In addition, New Mountain Finance’s total credit score high-quality seems to be favorable, and the company growth organization covers its dividend payments with net expense income.