Intel Stock: Market Gives Away Its Foundry Business (NASDAQ:INTC)

Chip Somodevilla

Thesis

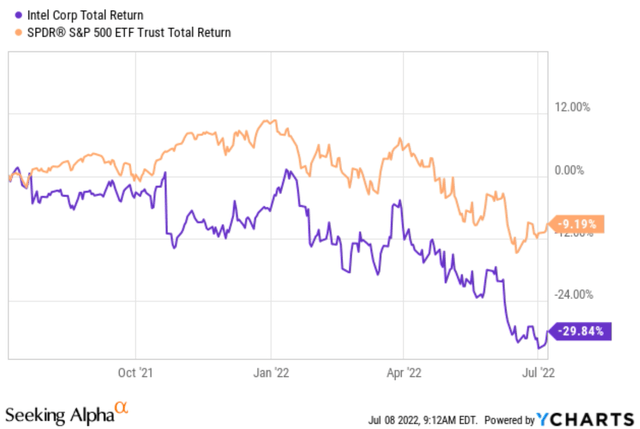

Intel (NASDAQ:INTC) stock price suffered sizable corrections after the March quarter earnings release for a couple of reasons. Business fundamentals suffered a decline and the tough comparison from last year made the numbers appear even more ugly. EPS fell to $0.87 from $1.39 last year. The operating margin was also under pressure and contracted by 12% to 23.1% compared to last year. At the same time, the broader market itself suffered a correction. As you can see from the following chart, the S&P 500 fell by 9.2% YTD, and most of the correction occurred since April.

Such corrections have brought its valuation to a level that is too contracted to ignore. The market pendulum has swung too far to the fear extreme. You will see in this article that under the current conditions, investors not only are paying for the core chip business at a discount but also getting the foundry business for free. The market is also totally ignoring other catalysts and growth opportunities (such as Data Center, AI, and Mobileye, to name a few), as elaborated on immediately below.

Seeking Alpha

Get the Foundry business for free

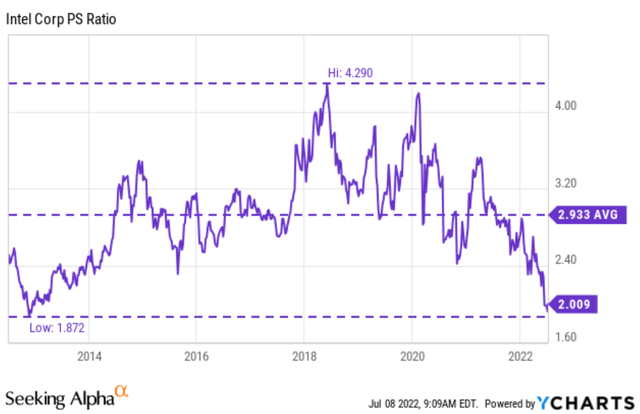

As shown in the next chart, INTC is currently valued at about 2.0x price to sales (“P/S”) ratio, close to the bottom level in a decade. It is simply too cheap both in relative terms and absolute terms. Historically, the stock has been selling at an average P/S in the range of 1.8x to 4.2x, with a long-term average of 2.9x. For reference, the overall market represented by the S&P 500 is currently valued at 2.48x P/S, and the Nasdaq 100 is valued at about 4.6x. So INTC’s existing core business is valued at a significant discount, by about 20% relative to the S&P 500, about 30% relative to its historical average, and about more than 50% relative to the NASDAQ 100 index.

Seeking Alpha

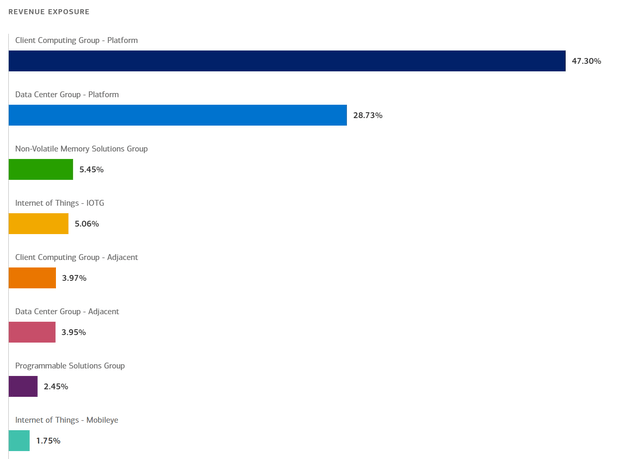

To put things in a different way, consider the following chart. Its 2021 total revenues dialed in at $74.7B. And its existing core chip business (Client Computing Group and Data Center Group) generates about 75% of the total revenue, translating to about $56B. Assuming a P/S ratio of 3x, close to its historical average, these two existing cores would be worth $168B. At its stock prices as of this writing, its market cap is about $153B. As such investors are getting the core businesses at a slight discount and getting all the other components for free.

Admittedly, many of these other components are still in their early stages and ultimate success remain uncertain. So here I will just focus on one of them, the foundry initiative, which I view as the most certain item as detailed next.

Source: Merrill Edge report

The IFS initiative

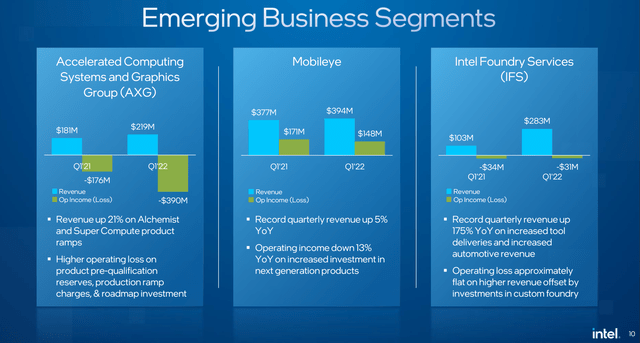

The IFS is relatively minor at this stage (about $283M in total in Q1 2022, its record quarterly revenue so far). The growth potential is tremendous. Its 2022 Q1 revenues went up 175% YoY thanks to increased tool deliveries and increased automotive revenue. INTC is aggressively pursuing the IFS via both acquisitions and its own investment.

On the acquisition front, it just announced the acquisition of Tower Semiconductor for $5.4B. The acquisition will provide direct access to a chip foundry as commented by the following news release (abridged and emphases added by me)

- The acquisition accelerates Intel’s path to becoming a major provider of foundry services and capacity globally, now offering one of the industry’s broadest portfolios of differentiated technology.

- Highly complementary transaction brings together Intel’s leading-edge nodes and scale manufacturing with Tower Semiconductor’s specialty technologies and customer-first approach…

- Transaction is expected to be immediately accretive to Intel’s non-GAAP EPS.

On its own, it plans to invest $20B to build a foundry facility in Ohio. And the company has just officially announced that it has acquired the land needed for this foundry plant according to the Columbus Dispatch reports. In the meantime, it also announced new R&D and fab investments in Europe. Its IFS has already attracted the interest of more than 100 potential customers including major names like Qualcomm and Amazon (AMZN).

Finally, the IFS initiative also enjoys the government’s support. The White House had recently pledged $52 billion toward building America’s chip industry. And INTC’s IFS will be a major beneficiary if the act is passed (although there are uncertainties to be analyzed in the risk section).

INTC earnings report

Projected returns

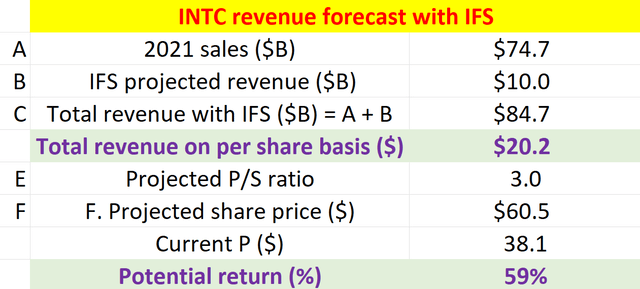

The global foundry industry is expected to grow into a $100 billion addressable market in the next few years. I project INTC’s IFS to have a market share of around $10B in a few years ($20B investment at 0.5x asset turnover rate) as shown in the table below. Therefore, even assuming its current core businesses stagnate completely at their 2021 level, the total revenue will be $84.7B once its IFS is online, or $20.2 per share. With a 3.0x P/S multiple, the projected share price will be $60.5, about 59% potential upside from its current price.

Author

Other catalysts and risks for INTC

Besides the IFS initiative, there are a few other catalysts unfolding for INTC too. As shown in an early chart, several of its new segments (such as NEX and Mobileye) all achieved record quarterly revenue and reported rapid growth. In particular, INTC has tapped Goldman Sachs (GS) and Morgan Stanley (MS) to lead the IPO of its Mobileye segment according to a Reuters report. Mobileye could be valued at as much as $50 billion (and INTC paid $15 billion for it about five years ago). The IPO could provide further resources for INTC to pursue high-growth and high-margin areas.

Finally, risks. As aforementioned, the White House pledged $52 billion toward building America’s chip industry, but there are uncertainties about this act passing. Last month, Senator Mitch McConnell threatened to block the act if Democrats pursue a broader spending package. INTC might have to delay or scale back its IFS if the CHIPS Act does not pass.